ENB Budget Series

நிதிமூலதனக் கடன் வட்டி, கட்ட வரி வேட்டை!

Budget 2025 signals fiscal ambition but risks remain: Fitch

20 February 2025 FT

> Says if proposed revenue measures are executed as planned, they could help address a long-standing weakness in country’s credit profile

> Cautions that government’s decision to slow pace of fiscal consolidation could hinder efforts to reduce debt in medium term

> Says medium-term fiscal outlook for Sri Lanka remains challenging

> States revenue growth is likely to slow sharply from 2026, unless additional policies are introduced

> Assumes divergence from programme’s projections implied in budget will not prompt IMF to suspend disbursements under EFF

> Warns that limited progress on debt reduction could weigh on Sri Lanka’s credit profile and leave government with little room to manoeuvre in event of economic shocks

> Sri Lanka’s Budget 2025 signals a strong push to boost fiscal revenues but risks to the country’s financial stability remain significant, Fitch Ratings warned.

Commenting on President Anura Kumara Dissanayake’s maiden budget, presented on Monday, the rating agency noted that if the proposed revenue measures are executed as planned, they could help address a long-standing weakness in the country’s credit profile.

However, Fitch cautioned that the government’s decision to slow the pace of fiscal consolidation could hinder efforts to reduce debt in the medium term.

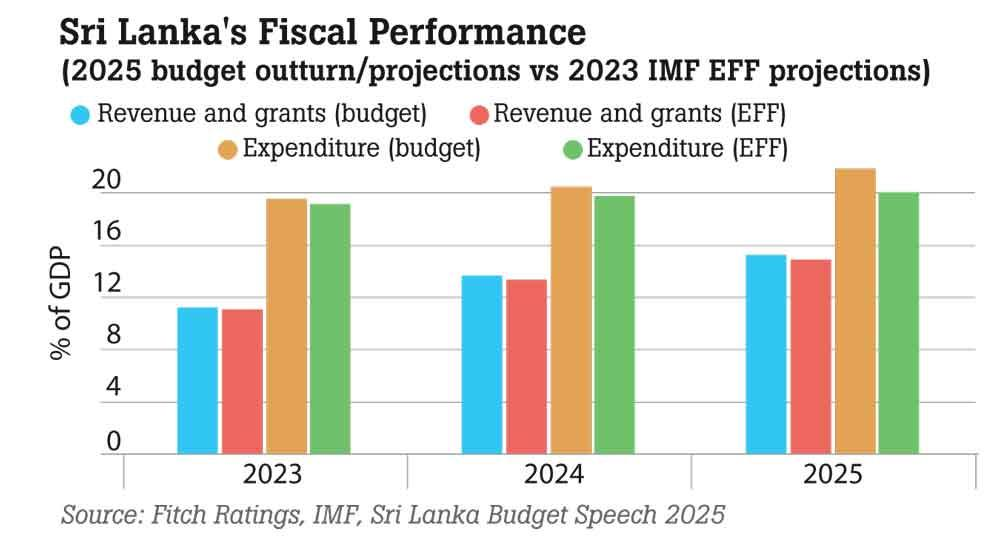

The budget provides “greater clarity” on the administration’s economic reform agenda and aligns with Fitch’s December 2024 assessment, when Sri Lanka’s rating was upgraded to ‘CCC+’, from ‘RD’ (Restricted Default). The 2024 budget deficit, which stood at 6.8 percent of GDP, was in line with the agency’s expectations.

A key focus of Budget 2025 is ramping up revenue collection. The government aims to increase revenue as a share of GDP to 15.1 percent in 2025, up from 11.4 percent in 2023, exceeding Fitch’s initial assumption that this threshold would only be reached by 2026. The budget outlines a 36.5 percent rise in revenue from taxes on external trade and a 13.1 percent increase in income tax revenue.

Fitch believes this ambitious target is achievable, given the revenue-raising measures already announced and implemented. However, much depends on the smooth liberalisation of import restrictions, particularly for vehicles.

“There remains a risk that the authorities could look to slow that process, if higher imports weaken Sri Lanka’s external stability, for example by eroding foreign-exchange reserves,” the rating agency warned.

“The medium-term fiscal outlook for Sri Lanka remains challenging and we believe revenue growth is likely to slow sharply from 2026, unless additional policies are introduced.”

Despite the revenue push, Sri Lanka’s public finances remain fragile. The budget projects only a slight reduction in the fiscal deficit to 6.7 percent of GDP in 2025, reflecting a sharp increase in government spending. Public capital expenditure is set to rise by 61 percent, while salaries, wages and subsidies will increase by 12 percent and 11 percent, respectively.

Fitch noted that “the deficit could be smaller than the government expects, if implementing such a large capex increase proves difficult.”

However, it cautioned that keeping public investment at the low levels seen in 2024 (2.7 percent of GDP) could dampen Sri Lanka’s medium-term growth prospects, even as other budget measures seek to attract private investment in export-oriented sectors and infrastructure.

The budget’s fiscal consolidation path is also slower than what was initially envisioned under Sri Lanka’s four-year, US $ 3 billion Extended Fund Facility (EFF) programme with the International Monetary Fund (IMF).

While the government still expects to meet its primary budget surplus target of 2.3 percent of GDP in 2025, interest payments, projected at 8.9 percent of GDP, are significantly higher than anticipated under the IMF programme.

“We assume the divergence from the programme’s projections implied in the budget will not prompt the IMF to suspend disbursements under the EFF,” Fitch said.

“However, the slow pace of fiscal consolidation is notable, given that the government’s projected medium-term growth rate of 5 percent is well above that envisioned in the EFF.”

On February 28, the IMF Executive Board will meet to assess the third review of its programme with Sri Lanka.

Fitch warned that limited progress on debt reduction could weigh on Sri Lanka’s credit profile and leave the government with little room to manoeuvre in the event of economic shocks.

Budget 2025 signals fiscal ambition but risks remain: Fitch